Garuda Indonesia at a Glance

Indonesia’s aviation market is the second-fastest-growing in the world after China, according to its aircraft purchases and trade value. (Statista, 2020). With its 17,000 islands extending up to more than 5000 kilometers from east to west, making air transportation the fastest way to travel around the country, thus the high demand for air transports. However, just like other industries, the aviation industry also struggles with travel restrictions and high number of Covid-19 cases, leading to low demand that affected the financial performances of critical airlines in Indonesia. This includes Garuda Indonesia, the nation’s flagship airline, whose finances are worsened by the Covid-19 travel restrictions, aside from the pre-existing financial issues long before the pandemic.

Illustration 1: Garuda Indonesia

Source: WallpaperAccess, n.d.

Garuda Indonesia is the national flag carrier of Indonesia, connecting more than 90 destinations worldwide. It currently operates 202 aircraft, with Garuda Indonesia as a main brand with a total of 144 aircrafts, and Citilink as the Low Cost Carrier (LCC) operating 58 fleet aircraft. The airline has maintained its service excellence, and serves its passengers with the award-winning “Garuda Indonesia Experience” service, strongly highlighting Indonesia’s warmth and hospitality as well as diverse cultures. (Garuda Indonesia, n.d.). The airline continuously strives to offer the best services and acquire achievements such as a recognition as Skytrax’s 5-star airline, and ranked as Top 10 World’s Best airline. These achievements are remarkable, yet Garuda Indonesia has a long existing financial issue, in which the Covid-19 pandemic has made it worse.

Garuda Indonesia’s Main Issues

The pandemic has adversely impacted Garuda’s revenue and earnings, which causes the airline’s share trading to be halted due to a bond default. The CEO, Irfan Setiaputra, claimed the airline’s total debt was Rp 70 trillion (US$4.9 billion). (Guild, 2021) This major debt had led to numerous government support including injections of state capital, privatisation or bankruptcy proceedings while the company restructured its debt. The company’s financial condition lies in the fact that its liabilities exceed assets, leading to financial insolvency. Adding to the pandemic travel restrictions, Garuda Indonesia had experienced a fall in passenger numbers from 193,380 in February 2020, to 8,967 in 2021 (Guild, 2021) This means that the company has worsened in revamping their financial circumstances.

The airline has experienced several daunting issues in their financial terms. Aside from it being the high amount of debt piling up and its operational hindrance by Covid-19 pandemic, another important root cause is its mismanagement. The Garuda Indonesia labour union (2021) has highlighted the prominent cause of Garuda is its business fundamentals that need to be reorganized and restructured. In order to optimize their revenues and business strategies, the company needs to fill its management with human capital who are experienced in the airline industry. Hence, showing that restructuring debt and receiving funds from the government would not suffice, there needs to be a revamp in the people behind its corporate strategy.

The Implications towards Indonesia’s Economy

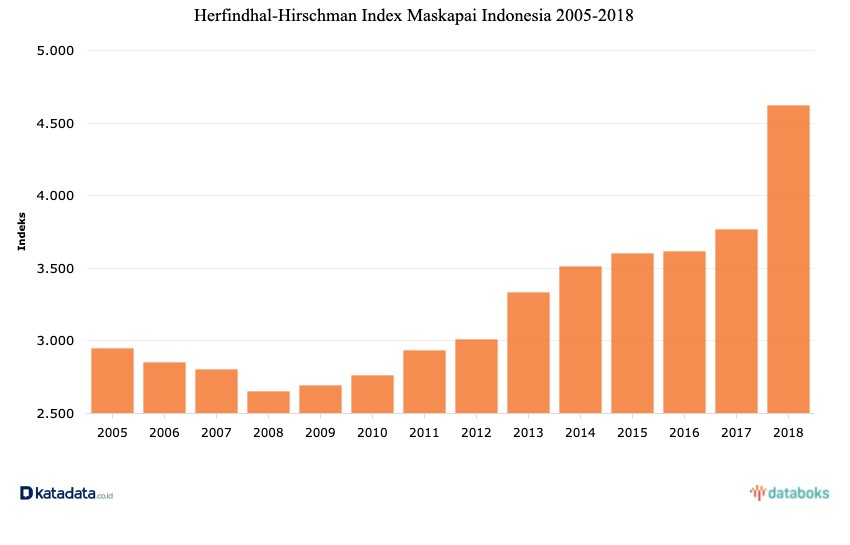

So, what’s in it for the country’s economy? The market concentration of the Indonesian aviation industry is incredibly high. The Herfindahl-Hirschman Index (HHI) is an index that shows market competitiveness or market concentration. The higher the HHI index, the more competitive the aviation market in Indonesia is, or that the market presents an oligopoly or duopoly market. In 2018, the HHI index in the aviation industry had risen by 858 points to 4624 points. In 2017, the level of the HHI index reached 3766 points. (katadata, 2018) This increase in HHI index is caused by the operational takeover of Sriwijaya Group by Garuda Indonesia Group. This takeover had caused a decrease in the potential of other airline companies to compete with the two airline giants, which are Garuda Indonesia and Lion Air Group.

Figure 1: HHI Index of Indonesian Aviation Industry 2005 – 2018

Source: Katadata, 2018

The implication of being in a duopoly aviation market means the prices are controlled by the two giant airlines. However, both airlines are of different types; one is a profit-maximizing company, and the other is a state-owned enterprise. Therefore, Garuda Indonesia as a state-owned enterprise can soften the price markup through regulatory oversight. Indeed, the bankruptcy of Garuda Indonesia at this point would have several implications as well towards consumer welfare, and one of which is the domestic prices.

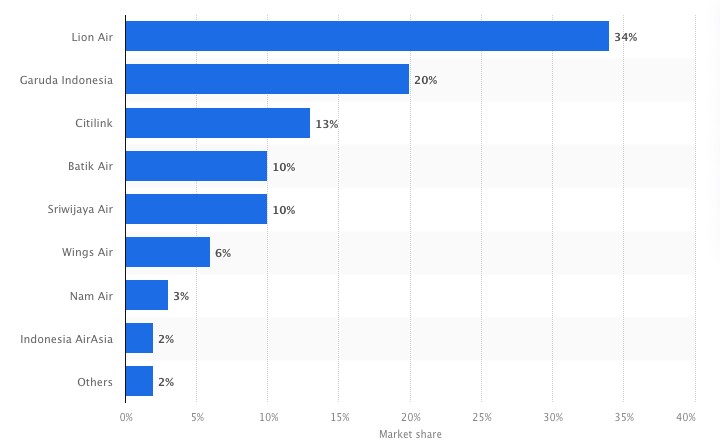

Having Garuda Indonesia as a state-owned airline would give the country some leverage in controlling domestic prices. It is inevitable that the important government priority is to make domestic air travel affordable. This is because when ticket prices are cheap, it will grease the wheels of the economy as it leads to more flights, more tourism, and more business deals. Prices are controlled in different means, including through regulatory oversight. From the perspective of Indonesian market share, Lion Air had the highest share in 2017, reaching 34 percent, followed by Garuda Indonesia’s share of 20 percent, and then its subsidiary Citilink with 13 percent. (Statista, 2017) This high market power held by Garuda Indonesia and Lion Air shows that the bankruptcy of Garuda Indonesia will give more market power to Lion Air Group in the market. Seeing it as a profit-maximizing company, the consumers could suffer from an increase in price markup in the short term and to some extent the long term.

Figure 2: Market share of domestic airlines in Indonesia in 2017, by type

Source: Statista, 2017

Aside from being a tool for the state to control domestic prices, Garuda Indonesia also has another function to operate geopolitically important destinations that are not tapped by other commercial airlines. For instance, Garuda Indonesia operates a direct Jakarta to Tokyo route because Japan and Indonesia have important business relationships, thus maintaining strong connections with destinations such as ADBI would leverage value for the Indonesian state beyond the revenues or profit from the route itself. (Guild, 2021) On the other hand, Lion Air does not operate that route, simply because the margins are not presented there. This means the closure of Garuda Indonesia would not only affect domestic prices, but also the convenience and geopolitical matters of the state and the people, which would ultimately affect the country’s socioeconomic sectors. Thus, having Garuda Indonesia as the flag carrier is part of the matters of international relations and economic relationships than it is about the profits or revenues generated from the operations.

Another important implication of Garuda Indonesia’s bankruptcy is the employment. The closure of the company would lead to a high number of workforces to be unemployed. Although it may not affect the country’s unemployment rate significantly, it is inevitable that the company employs over 17,000 employees from all across Indonesia. To date, the company has dismissed over 2000 employees, and cut their salaries by 50 percent. (Azka, 2021) Aside from it being an effort to survive through the pandemic, it is also a way to decrease their liabilities and financial burden. Thus, it can be seen that Garuda has a high labour absorption, hence its bankruptcy would affect more workers at an individual level, while subtly but critically contributing to the nation’s unemployment rate.

Government Policies

To mitigate the risks of the bankruptcy and prevent the airline from bankrupting, the state has several policies to ensure the airline’s survival. The government has been committed to help state-owned enterprises in terms of working capital since 2020, including for Garuda Indonesia. Based on the Government Regulation (PP) Number 23 of 2020, and amended by PP No.43 of 2020, it stipulates that under the circumstances of implementing the National Economic Recovery (PEN) program, the government can conduct placement of funds, government investments, guarantees, and government spending. (Yuniarto, 2021)

Based on the Minister of Finance Regulation No. 118/PMK.06/2020, and KMK 533/KMK.06/2020 concerning Non-Permanent Investment of the National Economic Recovery Program (IP PEN), the government aims to protect, maintain, and improve the economic capacity of the affected State-owned Enterprises, including Garuda Indonesia. Based on these regulations and reports, Garuda Indonesia is then eligible to receive an investment amounting to Rp 8,5 trillion, which will be disbursed in stages through the Mandatory Convertible Bonds (OWK) issuance scheme. (IDN Financials, 2020) Despite this high amount of funds given by the government, the company is still challenged by the unending pandemic, hence the low demand for air transports. Thus, in order for the policies to come into effect, the company’s performance needs to be boosted by the boost in the number of consumers as well.

The future outlook on the aviation industry would vary depending on the circumstances that come around. One way for Garuda Indonesia to rebound is through its negotiation with lessors. The Indonesian Minister of State-owned Enterprise, Erick Thohir, has mentioned that the expensiveness of aircraft leasing was the main root cause of its financial issues. (IDX Channel, 2021). This negotiation aims to reduce the liabilities that Garuda has towards its 36 aircraft charter partners. Another important outlook is its potential to be a part of Indonesia’s newly formed Holding Company, Aviata. Aviata, or PT Aviasi Pariwisata Indonesia, is the state-owned holding company of multiple airline and tourism-based companies that aims to boost the tourism sector and revamping post-pandemic recovery in Indonesia. Following that, the Vice Minister of State-owned Enterprise mentions that Garuda Indonesia is hoped to be a part of Aviata in 2023, after debt restructuring. (Victoria, 2021)

Future Outlook

To answer the question of whether Garuda Indonesia is on the brink of bankruptcy: yes. However, many efforts have been taken to ensure the sustainable survival of the company. The airline holds an important role as the nation’s flag carrier, which also acts as a market price regulator, as well as a means of the state’s geopolitical matters with international partners.

Thus, in conclusion, seeing the company’s large potential to grease the wheels of the economy and its impact on socio-economic activities, becomes the reason why the government has been fighting for the recovery of the company, despite its current entrenched issues and problems. The high amount of debt and mismanagement have deeply rooted in the system, causing the prolonged challenges for the company. However, as the pandemic is recovering, Garuda and the rest of the airlines in the country would see some hope for rebounce and back to serving as the nation’s flag carrier.

Bibliography

Azka, R. M. (2021, July 14). Curhatan Karyawan Garuda (GIAA) ke Jokowi: PHK Sudah 2.000 Karyawan, Gaji Kami Korbankan. Bisnis.com. https://market.bisnis.com/read/20210714/192/1417756/curhatan-karyawan-garuda-giaa-ke-jokowi-phk-sudah-2000-karyawan-gaji-kami-korbankan

Garuda Indonesia officially issues mandatory convertible bond. (2020, December 29). IDNFinancials. https://www.idnfinancials.com/news/37560/garuda-indonesia-officially-issues-mandatory-convertible-bond

Guild, J. (2021, July 7). Is Garuda Indonesia on the brink of bankruptcy? East Asia Forum. https://www.eastasiaforum.org/2021/07/07/is-garuda-indonesia-on-the-brink-of-bankruptcy/

Harian Kompas. (2021, September 30). Upaya Menyelamatkan Garuda Indonesia. Kompaspedia. https://kompaspedia.kompas.id/baca/infografik/kronologi/upaya-menyelamatkan-garuda-indonesia

mediaindonesia.com developer. (2019, March 11). Pasar Penerbangan Cenderung Oligopoli. mediaindonesia.com, All Rights Reserved. https://mediaindonesia.com/ekonomi/222012/pasar-penerbangan-cenderung-oligopoli

Ramalan, S. (2021, June 4). Ternyata Ini Biang Kerok Penyebab Garuda Nyaris Bangkrut. https://www.idxchannel.com/. https://www.idxchannel.com/economics/ternyata-ini-biang-kerok-penyebab-garuda-nyaris-bangkrut

The Diplomat. (2021, July 6). The Curious Case of Garuda Indonesia. https://thediplomat.com/2021/07/the-curious-case-of-garuda-indonesia/

Victoria, A. O. (2021, October 22). Wamen BUMN targetkan Garuda bergabung dengan Holding Aviata pada 2023. Antara News. https://www.antaranews.com/berita/2474869/wamen-bumn-targetkan-garuda-bergabung-dengan-holding-aviata-pada-2023

Yunus, Y., Musa, M. I., & Wardhana, M. I. (2020). Analisis Tingkat Kebangkrutan PT. Garuda Indonesia (Persero) Tbk. Program Studi Manajemen, Fakultas Ekonomi, Universitas Negeri Makassar. Published.